Fed rate hike

Georgii Boronin Getty. There is growing disagreement among economists about the peak or terminal rate of this hiking cycle.

The Latest Fed Rate Hike Is The Largest In 28 Years Here S The Silver Lining For Savers Nextadvisor With Time

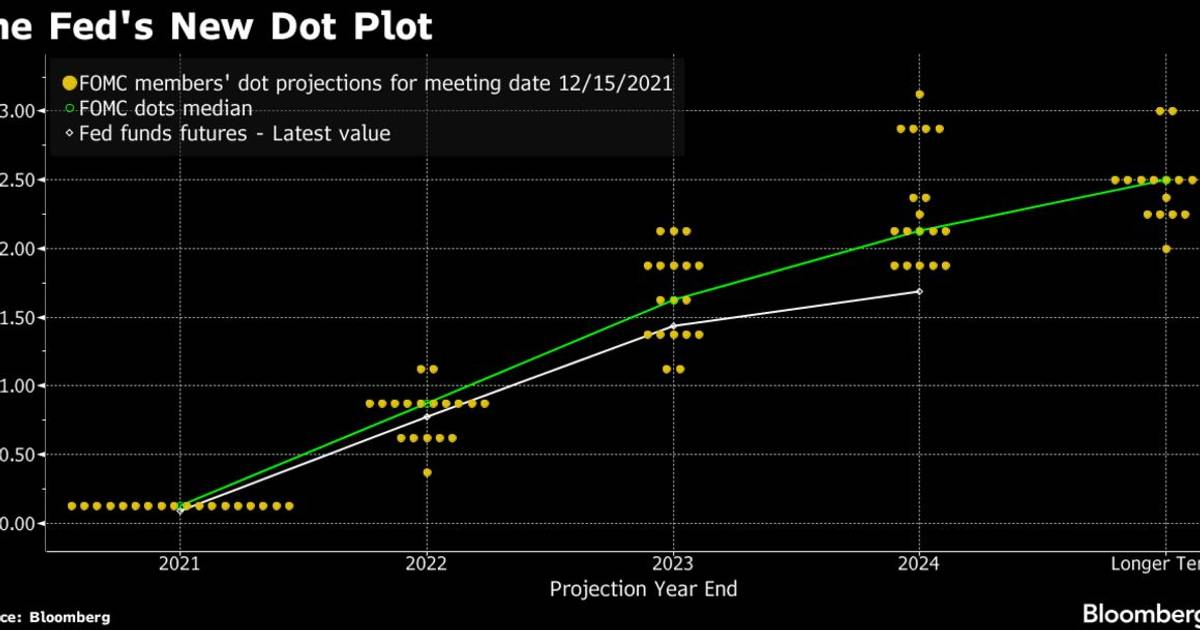

The Fed has penciled in a terminal rate in the range of 45475.

. 5 hours agoThe Federal Reserve opted for yet another 75-basis-point rate hike at Wednesdays FOMC meeting. To help stave off rising inflation the Federal Reserve announced Wednesday a benchmark interest rate hike of 025 the first increase since 2018. The Feds five hikes so far in 2022 have increased rates by a combined 3 percentage points or 300 in interest added on every 10000 in debt.

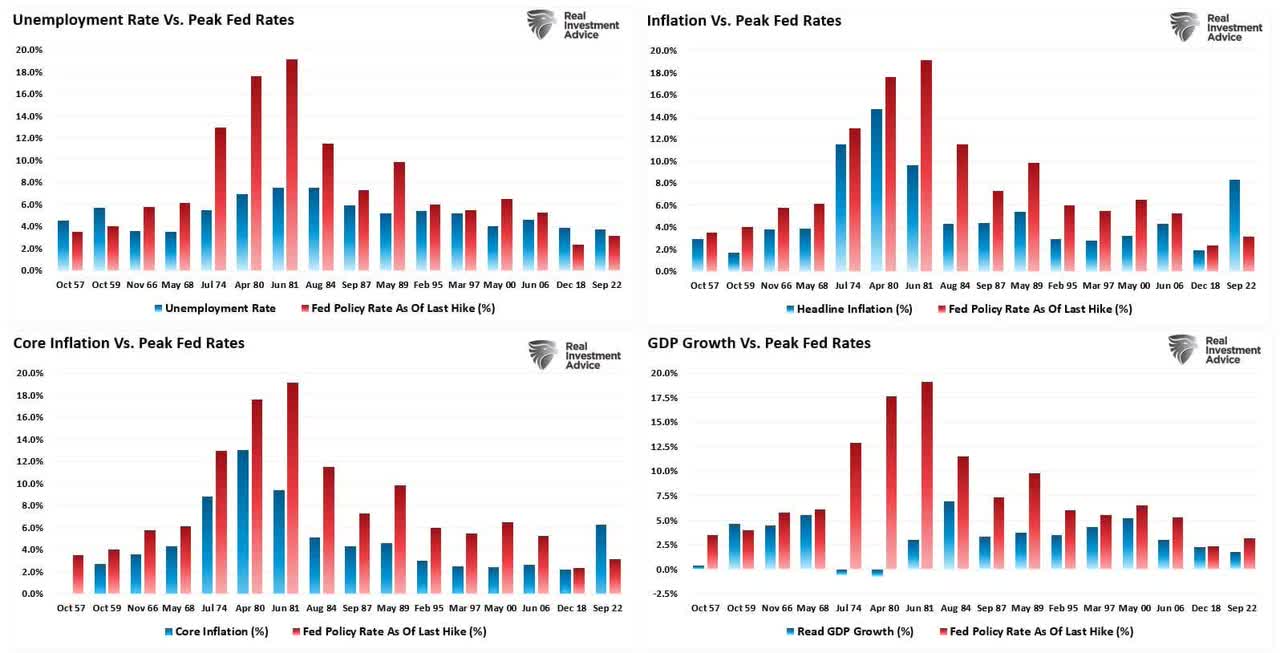

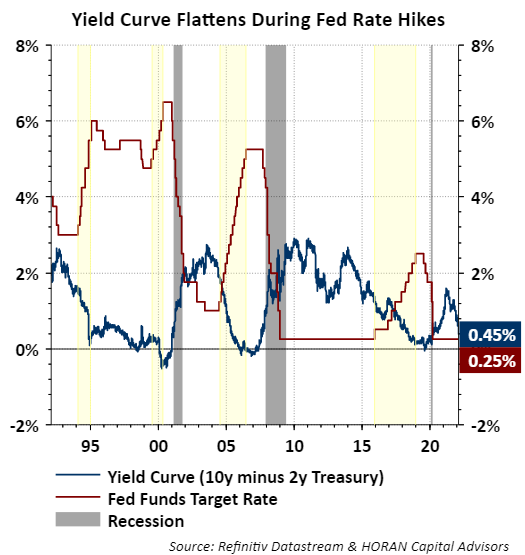

Rate hikes are associated with the peak of the economic cycle. 1 day agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. 1 day agoThe Federal Reserve raised interest rates by another three-quarters of a percentage point taking its benchmark federal funds rate to a range of 375 to 4 in an effort to tame.

Adjustable-rate loans such as ARMs. What Is a Fed Rate Hike. The fed funds rate sets the level that banks charge each other for overnight.

Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023. Fed Chairman Jerome Powell hinted at stepping off the gas in the future but. Prices rose by a hotter-than-expected 83 in August while core inflation a measure that excludes volatile food and energy prices jumped by 63.

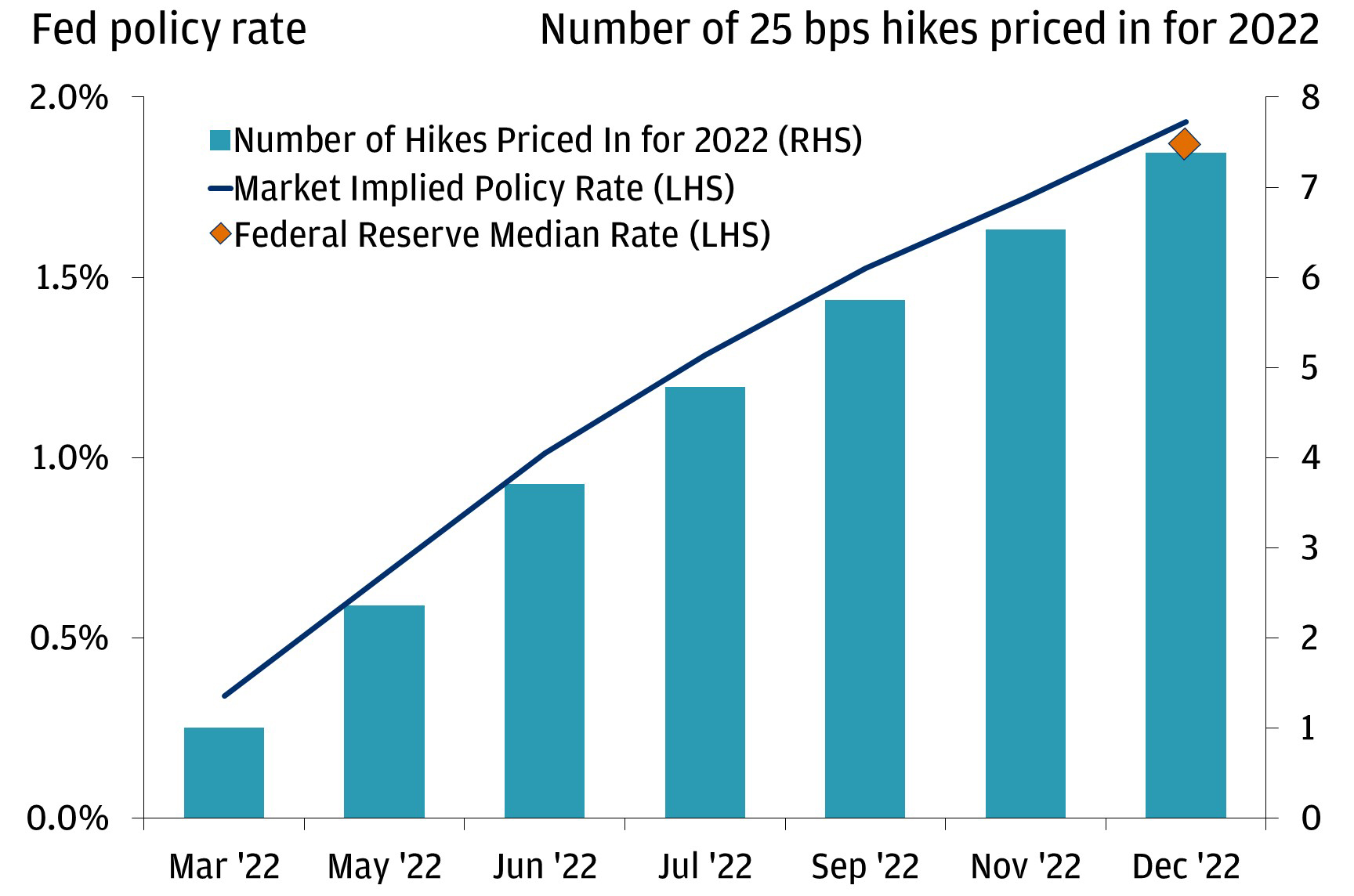

Today the Fed raised rates 075 as broadly expected in a consensus decision backing away from a 1 rise that was an outside possibility. Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to.

The Fed tried to cool off the economy and the growing real estate bubble by hiking interest rates 17 times in two years raising the fed fund target rate by 4 percentage points over. How will it affect mortgages credit cards and auto loans. The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point.

For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. Historically when interest rates rise the high cost of borrowing helps to slow the economy with fewer. The bank is moving at a level.

Rate hikes are the Feds main countermeasure against inflation. With three remaining meetings on. 1 day agoFed latest rate hike.

1 day agoCurrent market pricing also indicates the fed funds rate will top out near 5 before the rate hikes cease. 1 day agoThe Fed has already hiked rates five times this year the last three at 075 percentage points which used to be considered unusually steep. 1 day agoThe pace of the rate hikes has triggered global anxiety the Fed was dragging the world economy towards a point of no return with the dollars strength against major currencies.

A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. During his post-meeting conference Fed Chair Jerome Powell signaled. The Federal Reserve is anticipating multiple rate hikes in 2022 as the economy strengthens and concerns about inflation remain central to monetary policy.

That implies a quarter-point rate rise next year but. More specifically this refers to the rate at. This type of rate hike occurs when the US.

1 day agoPowell announced another interest rate hike on Wednesday. Central bank raises the interest rate that banks charge each other.

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Fed Swaps Fully Price Three Quarter Point Rate Hike In November Bnn Bloomberg

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

How The Stock Market Has Performed During Fed Rate Hike Cycles

How The Stock Market Has Performed During Fed Rate Hike Cycles

Fed Rate Hikes Approaching The Breaking Point Seeking Alpha

Rate Hikes The Fed Won T Hike Nearly As Much As Expected Real Investment Advice Commentaries Advisor Perspectives

Fed Hikes Rates By 0 75 Percentage Point Biggest Increase Since 1994

Tight Rope History S Lessons About Rate Hike Cycles Charles Schwab

What To Expect When The Fed Raises Interest Rates Youtube

Rate Hikes Are Back What Can Investors Expect Chase Com

Fed Rate Hikes And Recessions Horan

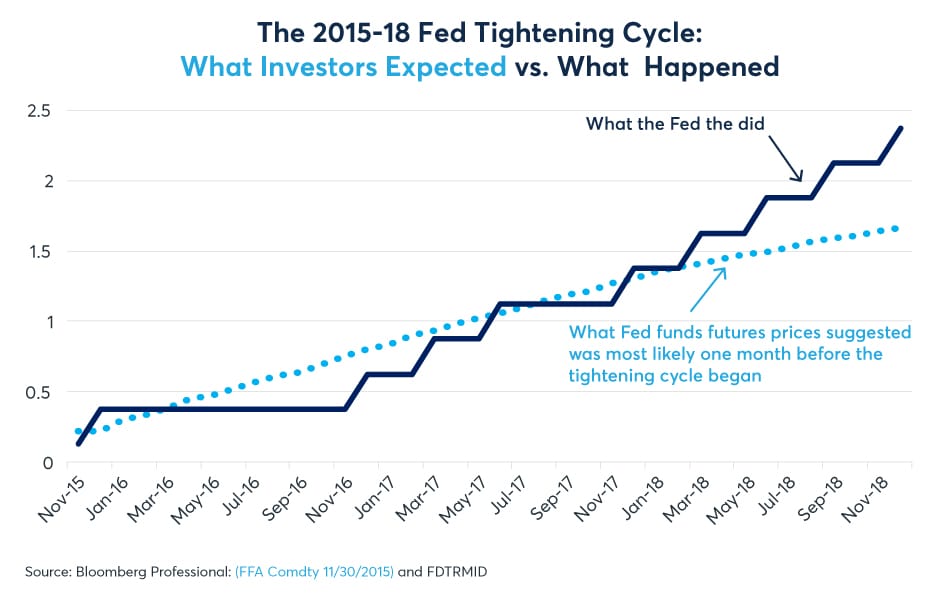

Fed Rate Hikes Expectations And Reality Benzinga

Wall St Down For Fourth Straight Day On Fed Rate Hike Worry By Reuters

Federal Reserve Approves Its Third Rate Hike Of The Year

Just What Does A Fed Rate Hike Mean Samco Appraisal Management Company

How Is The Federal Interest Rate Hike Going To Affect The Stock Market A Primer On Fed Rates And A Historical Analysis On How Changes In Fed Rate Affect The Stock